does wyoming charge sales tax on labor

Wyoming has a statewide sales tax rate of 4 which has been in place since 1935. Excise Taxes By State.

Connecticut Sales Tax Handbook 2022

No you do not pay sales tax on labor.

. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. Wyoming Use Tax and You. On top of the state sales tax there may be one or more local sales taxes as well as one or.

Groceries and prescription drugs are exempt from the Wyoming sales tax. The Excise Division is comprised of two functional sections. State wide sales tax is 4.

The state-wide sales tax in Wyoming is 4. Sales Tax By State. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from.

Wyoming also does not have a corporate income tax. Labor and material charges. Wyoming does not have an individual income tax.

This is the same whether you live in Wyoming or not. Section 5415b2 of the Sales and Use Tax Regulations provides. Mary owns and manages a bookstore in Cheyenne Wyoming.

The state sales tax rate in Wyoming is 4. Services that result in a. You can look up the local sales tax rate.

Remote and marketplace sellers. Does minnesota charge sales tax on labor. In addition Local and optional taxes can be assessed.

Businesses licensed under the Wyoming sales tax laws must report use tax on their sales tax return forms ETS Form 41-1 or 42-1 and 42-2. Contractors must report their use tax on forms. Under Floridas sales and use tax if no parts were used in the service and the charge was for labor only then there would be no tax to pay.

Groceries and prescription drugs are exempt from the Indiana sales tax. County Sales Tax Rates. Wyoming has a destination-based sales tax system so you have to pay.

Since books are taxable in the state of Wyoming Mary. Wyoming first adopted a general state sales tax in 1935 and since that time the rate has risen to 4. Effective July 1 2018 labor and installation charges are included in the definition of gross receipts subject to Kentucky sales tax KRS 139010.

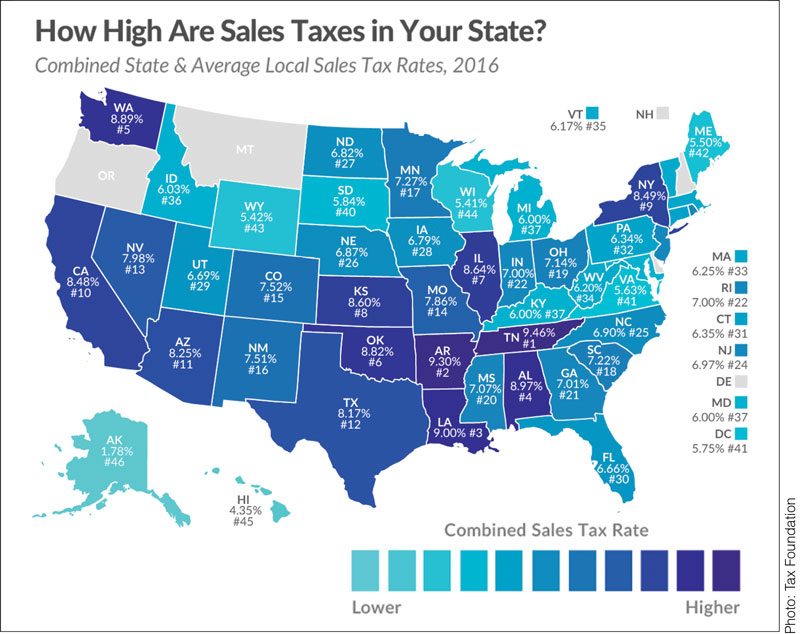

Wyoming sales tax rate is 4 and the maximum WY sales tax after local surtaxes is 7. Services are subject to sales tax in a number of states. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

It is also the same if you will use Amazon FBA there. Is there sales tax on home improvements in NY. Heres an example of what this scenario looks like.

Use Tax By State. The Wyoming Department of Revenue has issued a news bulletin regarding the taxability of professional services. Wyoming does not have a sales tax holiday.

But if any parts were used in the. Labor unions and workers organizations are exempt from taxation on dues and other. There are additional levels of sales tax at local jurisdictions too.

Remote sellers and marketplace facilitators must collect sales tax from retail sales into Wyoming if they meet the. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7.

Sales And Use Tax Explained The Business Professor Llc

Costs Fees To Form And Operate An Llc In Wyoming Simplifyllc

Sales Tax Laws By State Ultimate Guide For Business Owners

Lawmakers Vote Down Two Wyoming Bills Increasing Taxes On Renewable Energy

Which States Have The Lowest Tax Rates Seniorliving Org

Lawmakers Breathe Life Into Real Estate Transfer Tax Wyofile

States With The Highest Lowest Tax Rates

Sales Taxes In The United States Wikipedia

In Wyoming A Covid 19 Surge A Struggling Energy Economy And A Thriving Haven For The Rich

General Sales Taxes And Gross Receipts Taxes Urban Institute

.png)

State And Local Sales Tax Rates In 2014 Tax Foundation

Wyoming Changes Sales Tax Rules For Remote Sellers

Ranking State And Local Sales Taxes Tax Foundation

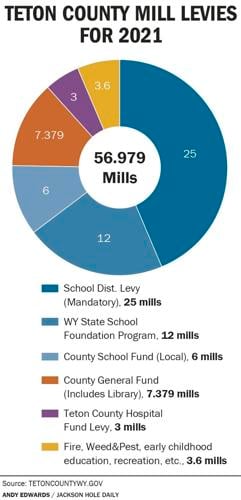

Property Taxes Largely Fixed By State Jackson Hole Daily Jhnewsandguide Com